Trade and Investment Insurance and NEXI

Trade and Investment Insurance business and NEXI

The Japanese Government established the trade and investment insurance program in 1950 as part of its export promotion policy. Since its establishment, the program had been managed directly by the Government for 50 years , playing a significant role in expanding exports and the development of overseas activities of Japanese companies. In April 2001, Nippon Export and Investment Insurance (NEXI), an incorporated administrative agency, was newly created as a 100% state-owned agency to effciently manage this program in unity with the Government.

Since then, all operations involved in the program have been conducted by NEXI, while the Government (Ministry of Economy, Trade and Industry: “METI”) remains in charge of overall planning and negotiation between countries, from the standpoint of Japanese trade policy as a whole.

After 16 years of history in acting as an Individual Administrative Agency,NEXI has been transformed into a 100% goverment-owned special stock company.

Having abolished the government provided reinsurance system, in the event of emergency where NEXI is faced with a difficulty in funding, countermeasures will be taken by the government as prescribed in the Trade and Investment Insurance Act to ensure secure payment of insurance claims.

NEXI continues to provide unchanged support to Japanese companies after the transformation.

Characteristics of NEXI

NEXI has instituted a medium term plan, with an aim to efficiently operate the organization focused on a medium to long term perspective, improve services to customers, and expand the risks it underwrites. By openly disclosing financial statements such as balance sheets and income statements prepared in accordance with the accounting principles used by private companies, and other information related to the management of corporations, the transparency of business management is enhanced. For personnel administration, a flexible job appointment system is carried out as an incorporated administrative agency. In addition, when undertaking trade and investment insurance for projects, full consideration is given to the environmental and social impact. NEXI’s role is to help Japanese companies conduct anxiety free overseas trading.

Trends of the Trade and Investment Insurance Program in Japan

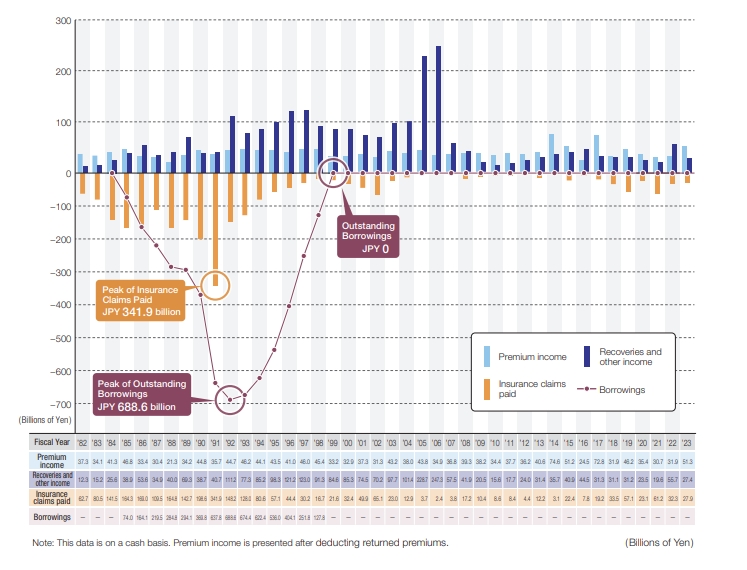

The record of the past experience of the trade and investment insurance program in Japan shows that the revenue and expenditure are balanced over the medium to long term, and a large amount of claim payments tend to concentrate on specific time periods.

In the first half of 1990s, borrowings from the government amounted to approximately JPY700 billion due to the debt crisis in Latin America, the dissolution of the Soviet Union, and the Middle East and the Gulf crisis. However, they were steadily recovered and outstanding borrowing came out even at fiscal year-end 1999.