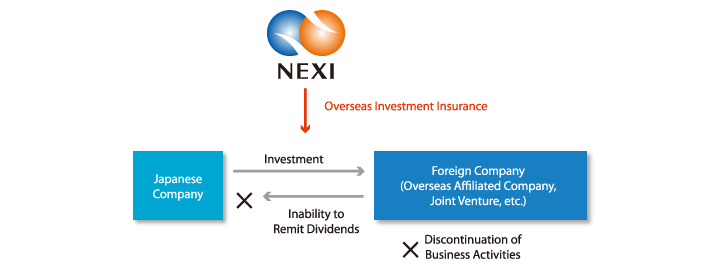

Overseas Investment Insurance

Insurance for investment (equity investment, etc.)

This insurance covers losses suffered by a Japanese company with a subsidiary or a joint venture in a foreign country. The losses are incurred when the relevant subsidiary or the joint venture is forced to discontinue business due to war, terrorism, or force majeure, such as a natural disaster. The insurance also covers losses incurred when a Japanese company is unable to remit dividends to Japan due to prohibition of foreign currency exchange or suspension of remittance.

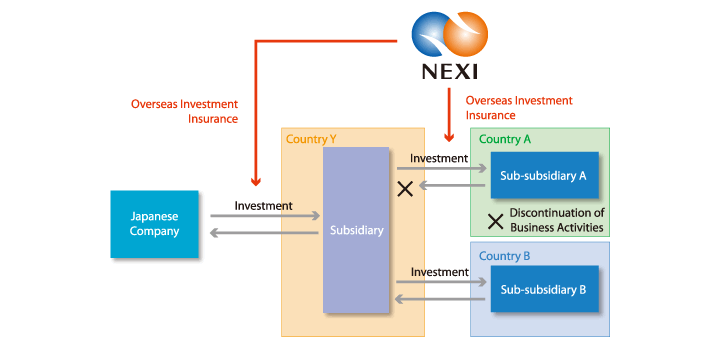

When a Japanese subsidiary establishes sub-subsidiaries in a number of countries, one subsubsidiary’s failure to continue business can be recognized as an insured event and insurance claims will be paid, regardless of the other sub-subsidiaries’ performance.

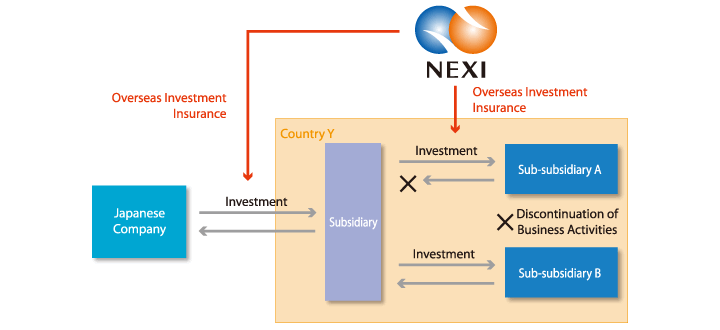

When a Japanese subsidiary in a foreign country establishes a number of sub-subsidiaries in the same country, one sub-subsidiary’s failure to continue business can be recognized as an insured event and insurance claims will be paid, regardless of the other sub-subsidiaries’ performance.

The other type of Overseas Investment Insurance covers rights and acquired profits (real estate, etc.), while the above insurance covers investment (equity investment, etc.).