NEXI has signed Statement of Intent with The National Treasury and Economic Planning of the Republic of Kenya for the Establishment of a Yen-Denominated Credit Line Facility (Samurai Loan)

Nippon Export and Investment Insurance

Nippon Export and Investment Insurance (NEXI) has signed a Statement of Intent with the National Treasury and Economic Planning of the Republic of Kenya (the “National Treasury of Kenya”) for the establishment of a yen-denominated (Samurai Loan) Credit-Line Facility on August 20, 2025.

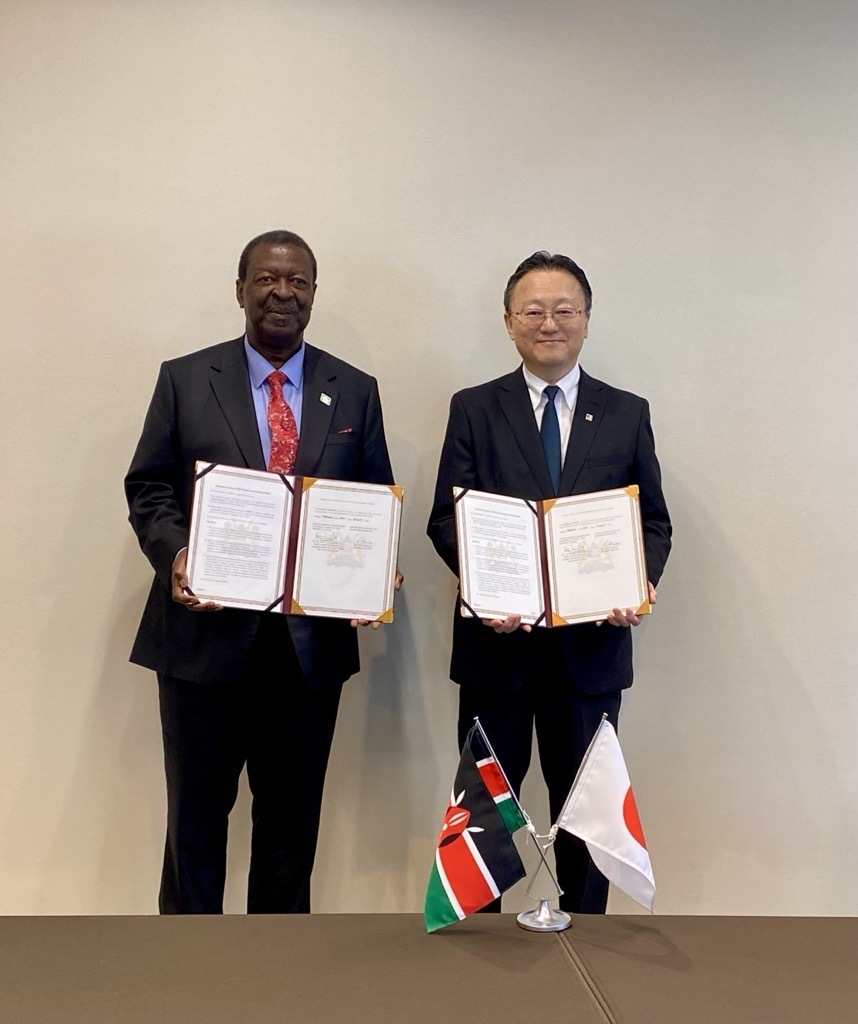

(Left:Hon. Dr. Mudavadi, EGH, Prime Cabinet Secretary and Cabinet Secretary for Foreign and Diaspora Affairs of the Republic of Kenya、Right:Atsuo Kuroda, Chairman and CEO of NEXI)

Credit:Prime Cabinet Secretary Kenya, Press Service

The Statement of Intent was formally unveiled during the Commemorative Ceremony for Signed Cooperation Documents at TICAD9, attended by Japanese Prime Minister Shigeru Ishiba, H.E. President William Ruto of Kenya, and H.E. President João Lourenço of Angola and Chairperson of the African Union Assembly. The announcement was jointly made by Atsuo Kuroda, Chairman and CEO of NEXI and Hon. Dr. Musalia Mudavadi, EGH, Prime Cabinet Secretary and Cabinet Secretary for Foreign and Diaspora Affairs on behalf of the National Treasury of Kenya.

(Commemorative Ceremony for Signed Cooperation Documents at TICAD9)

Credit:Japan External Trade Organization; JETRO

This Statement of Intent confirms mutual agreement on the key terms and conditions (Term Sheet) of a Credit Line Facility to provide yen-denominated loans, after rounds of extensive discussions between the two parties based upon the Memorandum of Understanding (MoU) announced at the “JETRO Kenya Business Forum” held on February 8, 20241, in the presence of Japanese State Minister of Economy, Trade and Industry Mr. Yoshida and H.E. President William Ruto of Kenya. The MoU was jointly presented by Dr. Chris Kiptoo, CBS, Principal Secretary of The National Treasury of Kenya and Kuroda of NEXI.

The Credit Line Facility, with a maximum facility amount of JPY 25 billion, is intended to support Kenya’s fiscal needs in promoting its National Automotive Policy (NAP) as well as its electricity loss reduction program for its transmission and distribution network, through yen-denominated loans (Samurai Loan) backed by NEXI’s loan insurance. The financing will be provided by Japanese commercial banks and insured by NEXI.

Kenya serves as a strategic gateway to East Africa with a growing number of Japanese companies in operation. In FY2023, Kenya and Japan celebrated the 60th anniversary of diplomatic relations. Strengthening ties with the Global South and advancing the vision of a Free and Open Indo-Pacific remain key priorities for Japan, and Kenya continues to be a vital partner of Japan.

This credit line is expected to support Kenya’s industrial development and local job creation by supporting the government’s efforts to grow its automotive industry. It is also anticipated to contribute to the sales of Japanese vehicles, which hold a strong market share in the Kenyan market. In addition, the facility will support the Kenyan government’s initiatives to reduce electricity loss rates across its transmission and distribution networks.

NEXI remains committed to deepening collaboration with governments and institutions worldwide, and to actively supporting the creation of business opportunities for Japanese companies in emerging markets, including Africa.

Contact:

Infrastructure Group

Loan Insurance Department

Tel: +81-(0)3-3512-7674