MOUs with Islamic Development Bank (IsDB), Islamic Corporation for the Insurance of Investments and Export Credit (ICIEC) and African Trade Insurance Agency (ATI)

-Japan Desk will be established under the MOUs-

Nippon Export and Investment Insurance

Nippon Export and Investment Insurance (NEXI; Chairman and CEO: Atsuo Kuroda) has signed three memorandum of understanding (MOUs) on cooperation with international financial institutions of the Islamic Development Bank (IsDB), Islamic Corporation for the Insurance of Investments and Export Credit (ICIEC) and African Trade Insurance Agency (ATI), taking the opportunity of the seventh Tokyo International Conference on African Development (TICAD 7) to be held from 28 to 30 August 2019. The signing ceremony took place on August 27 at the Ministry of Economy, Trade and Industry in Japan, in the presence of the Minister of Economy, Trade and Industry Hiroshige Seko.

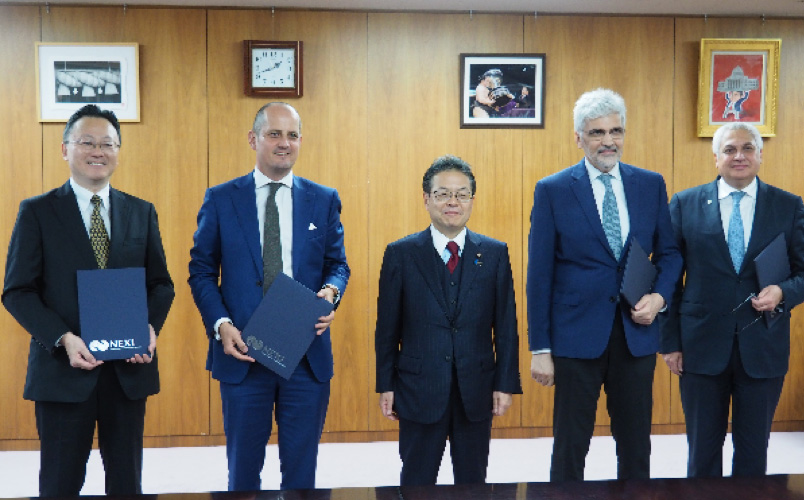

(From left side, Mr. Kuroda, Chairman and CEO of NEXI, Mr. Lentaigne, acting CEO of ATI, Mr. Seko, Minister of Economy, Trade and Industry, Dr. Jouini Vice President, Partnership Development of IsDB, Mr. Kaissi, CEO of ICIEC)

The MOUs, aimed at accelerating trade and investment in Africa by Japanese companies, seek to strengthen ties between NEXI and the three institutions with a strong track record of supporting business in the region, leading to the establishment of a cooperative framework to promote setting up projects.

While the African market seems to have a great potential for Japanese companies to enter into due to its strong demand for infrastructure, there has been said to be a bigger hurdle compared with when they tap into the Asian market. One of the bottlenecks is that some part of project cost shall be financed without official export credits support but many governments in Africa still face difficulty in borrowing such money from commercial banks without official export credits support.

In the circumstances, a recommendation from the private sector to strengthen the NEXI’s function through alliance with international financial institutions at the TICAD 7 Public-Private Roundtable Meeting was published in March 2019. In response, NEXI will develop the environment to facilitate financing proposals from Japanese companies through the active underwriting of insurance and the establishment of closer ties with the IsDB, ICIEC and ATI, each of which is authorized to provide finance or insurance/guarantee for relevant finance for down payment that the governments of project countries are required to arrange separately.

Additionally, in considering the significance of creating supportive environment for Japanese companies to consult IsDB, ICIEC and ATI, NEXI has reached an agreement with the three institutions that NEXI arrange trade and investment insurance training program for their staff and the three institutions assign their staff as Japan Desk officers for Japanese companies after their participation in the training program.

NEXI will continue to actively support business expansion overseas of Japanese companies including exports to, investments in, and loans for the African countries, by promoting closer ties with international financial institutions and governmental financial institutions in other countries and regions.

<Key items of the MOU>

1. Exchanging views on financial systems and business management of each institution

2. Exchanging information on individual projects between Japan and member countries of each institution

3. Sharing expertise on specific countries and sectors

4. Promoting cooperation in other fields such as human resources training and seminars for Japanese companies

5. Discussing future cooperation through measures such as co-financing and reinsurance

<Overview of each institution>

=IsDB=

IsDB is a multilateral development bank established in 1975 to support the economic development and social progress of its 57 member countries across four continents, touching the lives of 1 in 5 of the world’s population. IsDB is one of the world’s largest multilateral development banks. It has an authorized capital of $140 billion and a subscribed capital of $70 billion. As at the end of 2018, the IsDB Group cumulative net approvals reached $138 billion, including $7 billion approved in 2018. IsDB is headquartered in Jeddah, Saudi Arabia, and has a field presence in Morocco, Egypt, Senegal, Nigeria, Turkey, Kazakhstan, Indonesia, Bangladesh and Malaysia, with new offices set to open in the UAE, Uganda and Suriname.

https://www.isdb.org/

=ICIEC=

The Islamic Corporation for the Insurance of Investments and Export Credit (ICIEC) is a member of the IsDB Group, founded in 1994 as an international financial institution. With the aim of accelerating investment and trade in Islamic nations, the ICIEC provides investment insurance, export credit insurance and others. It is capitalized at approximately USD 400 million, joined by 46 member countries and headquartered in Jeddah, Saudi Arabia.

http://iciec.isdb.org/

=ATI=

ATI was founded in 2001 by African States to cover the trade and investment risks of companies doing business in Africa. ATI can insure the full spectrum of debt or equity investments. Specifically, ATI covers political/investment risks, performance risks and commercial risks. As of 2018, ATI had supported US$46 billion in trade and investments across Africa in sectors such as agribusiness, energy, exports, housing, infrastructure manufacturing, mining and telecommunications. For over a decade, ATI has maintained an ‘A/Stable’ rating for Financial Strength and Counterparty Credit by Standard & Poor’s, and it now has a recently obtained A3/Stable rating from Moody’s.

http://www.ati-aca.org/

Contact:

Policy Coordination Group Tel: #81-(0)3-3512-7456