Conclusion of Reinsurance Agreement with UKEF

Nippon Export and Investment Insurance

Nippon Export and Investment Insurance (NEXI: Chairman and CEO: Kazuhiko Bando) has concluded a One-Stop-Shop Reinsurance Agreement with UK Export Finance (UKEF).

The signing ceremony took place on August 30th in the UK at London between Mr. Louis Taylor, Chief Executive of UKEF and Kohei Okada, Managing Executive Officer of NEXI. NEXI has concluded reinsurance agreements with thirteen export credit agencies in Europe and Asia, and this will mark its fourteenth agreement.

Mr. Taylor, UKEF (left) and Mr. Okada, NEXI (right)

(Photograph courtesy of UKEF)

This reinsurance agreement provides a general framework for reinsurance underwriting between NEXI and UKEF. By concluding this agreement, NEXI and UKEF can cooperate in supporting the export of Japanese products through reinsurance where a transaction also involves UK exporters. This agreement can be applied widely to all ECA finance in which UKEF participates, but whether to apply will be determined separately for each individual case. NEXI is will provide support in terms of export credit to enhance industrial cooperation between Japan and the UK in a wide range of fields by proactively utilizing the reinsurance scheme based on this agreement.

As Japan’s governmental financial institution, NEXI will continue to expand its reinsurance network with other countries to actively support foreign export by Japanese companies.

| Official name: | Export Credits Guarantee Department |

| Operating name: | UK Export Finance (UKEF) |

| Location | 1 Horse Guards Road, London, SW 1 A 2 HQ |

| Number of staff | 233 (as of the end of March 2016) |

| Business contents | Export credit insurance, medium to long term guarantee, direct financing, investment insurance etc. |

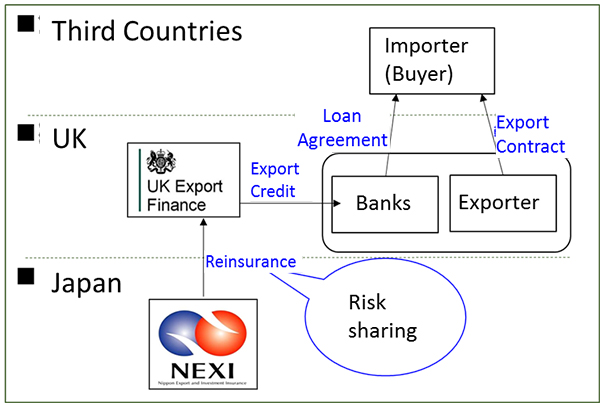

When a Japanese company joins a project in a third country in conjunction with a foreign company, One-Stop-Shop Reinsurance agreements make it possible for NEXl to undertake the risk portion of exports made from Japan. Suppose a Japanese company exports to a third country with a foreign company under a consortium, and the foreign company obtains insurance from its own ECA for the entire contract amount including the portion exported by Japanese company; NEXl will provide reinsurance to the foreign ECA for the portion exported from Japan.

It is called One-Stop-Shop because it allows you to apply for trade insurance at a single window for all export contracts involving companies from multiple countries.

| Service since | ECA (Original Partner) | Country |

| 2002 | Servizi Assicurativi Del Commercio Estero (SACE) | Italy |

| 2002 | Atradius (ATRADIUS) | Netherlands |

| 2002 | Ducroire / Delcredere (ONDD) | Belgium |

| 2003 | Euler Hermes Germany (EULER HERMES) | Germany |

| 2003 | Oesterreichische Kontrollbank Aktiengesellschaft (OeKB) | Austria |

| 2004 | Export-Import Bank of the United States (US EXIMBANK) | USA |

| 2004 | FINNERVA PLC(FINNVERA) | Finland |

| 2005 | Export Finance and Insurance Corporation (EFIC) | Australia |

| 2005 | Compañía Españoal a de Seguros de Crédito a la Exportación (CESCE) | Spain |

| 2007 | Swiss Export Risk Insurance (SERV) | Switzerland |

| 2011 | Korea Trade Insurance Corporation (K-sure) | Korea |

| 2016 | Bpifrance | France |

| 2017 | Export Guarantee and Insurance Corporation(EGAP) | Czech Republic |

Contact

Infrastructure Group

Structured and Trade Finance Insurance Department

Tel: +81-3-3512-7674