Reinsurance Network at Home and Overseas

Overseas Network(Short Term)

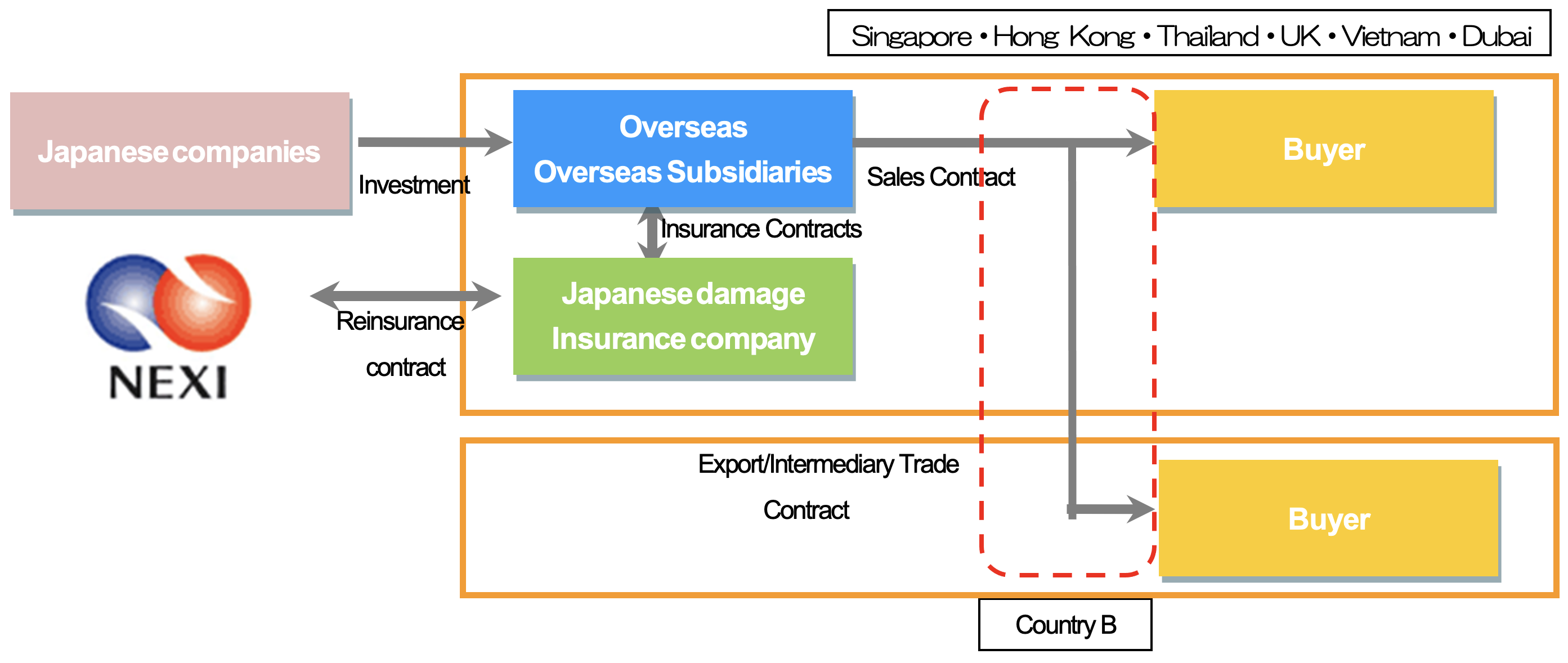

NEXI’s support was mainly focused on transactions from Japan to foreign countries such as export, outward investment and foreign lending. However, with more Japanese businesses expanding overseas, there has been a growing demand in recent years for our support for transactions conducted by their overseas subsidiaries, including domestic sales, exports and intermediary trades. To meet such demand, NEXI is providing a reinsurance scheme for protecting Japanese subsidiaries’ accounts receivable.

1. Fronting

”Fronting” presented by NEXI is a reinsurance scheme under which NEXIʼs insurance products are sold on behalf of NEXI by a primary insurer that holds a license to issue insurance policies overseas. The fronting scheme can ensure stable insurance capacity by covering risks that otherwise would not be covered.

This scheme is an “all Japan support program” offered by NEXI in close collaboration with Japanese non-life insurers’ overseas network.

Fronting(NTCI)

Fronting product line

| Name | Start of service |

Japanese Non-life Insurer (Ceding Partner) |

Location |

| Fronting (NTCI) |

2013 | Mitsui Sumitomo Tokio Marine & Nichido Sompo Japan |

Singapore Hong Kong Thailand |

| 2016 | Mitsui Sumitomo | U.K. | |

| 2018 | Mitsui Sumitomo Tokio Marine & Nichido Sompo Japan |

Vietnam | |

| 2022 | Tokio Marine & Nichido | Dubai | |

| 2023 | Mitsui Sumitomo | Dubai |

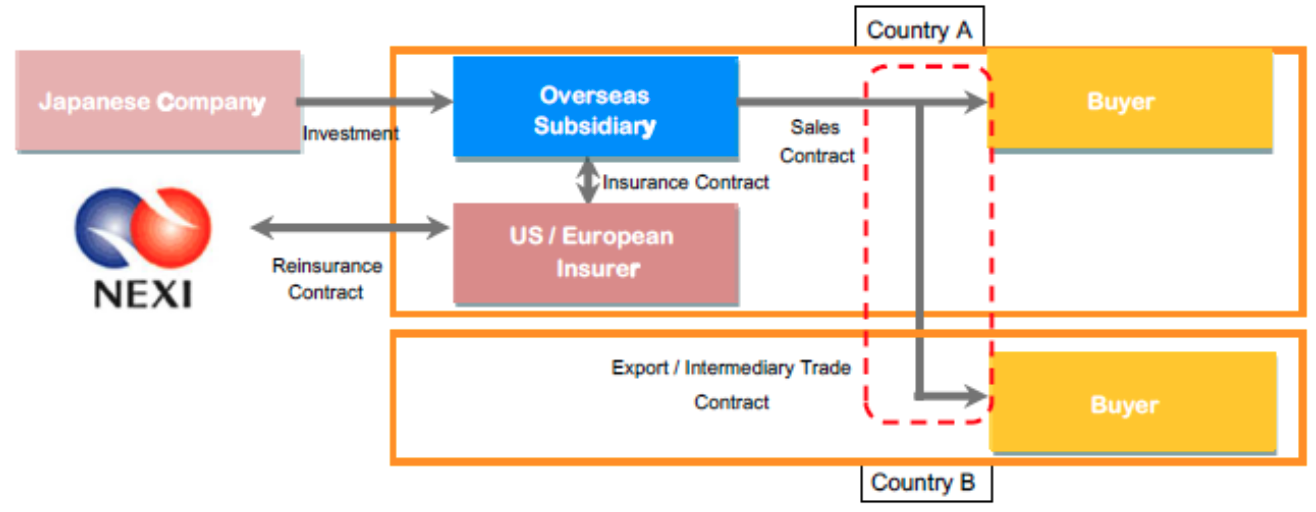

2. European and U.S. private-sector reinsurance

This is a reinsurance scheme that enhances underwriting capacity to offer coverage for risks in transactions in high-risk countries that are not covered by European and U.S. private-sector insurers, or when the maximum liability is insufficient. This reinsurance scheme can support overseas subsidiaries’ exports, intermediary trades and domestic sales in about 100 countries where Euler Hermes, Coface and AIG are operating services.

Scheme Image

European and US private-sector reinsurance

| Start of Service | European and US private-sector insurers (ceding partners) |

Location |

| 2013 | EULER HERMES (private sector) | 52 countries |

| 2014 | COFACE (private sector) | 96 countries |

| 2015 | American International Group, Inc. (AIG) | 62 Countries |

| 2016 | Tokio Marine HCC (HCC) | 29 Countries |

| 2019 | Mitsui Sumitomo Insurance Company (Europe) Limited / MS Amlin |

U.K. ・ Countries MSIG located |

| 2023 | Credendo Short-Term Non-EU Risks | European Countries |

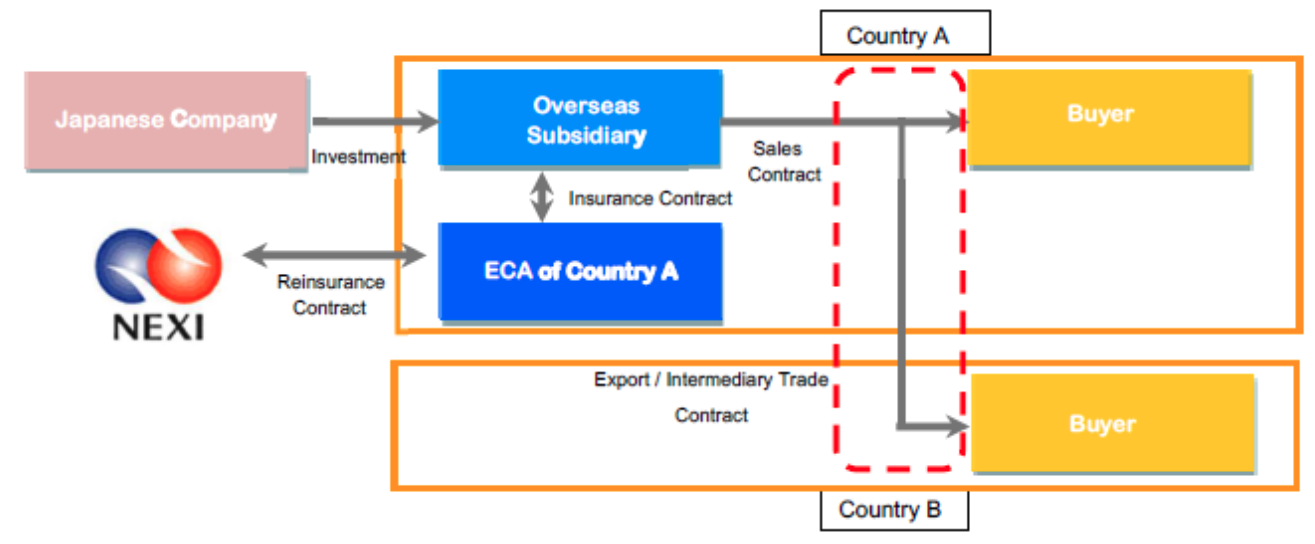

3. ECA Reinsurance

NEXI has a reinsurance agreement with each ECA in Asia to enhance their underwriting capacity. The increased capacity has brought more opportunities for the Asian ECAs to provide support for Japanese overseas subsidiaries.

Scheme Image

ECA Reinsurance

| Start of Service | ECA(Ceding Partner) | Location |

| 2006 | Export-Import Bank of Malaysia Berhad(MEXIM) | Malaysia |

| 2009 | Asuransi Ekspor Indonesia(ASEI) | Indonesia |

| 2009 | Export-Import Bank of Thailand(THAI EXIMBANK) | Thailand |

| 2010 | Taipei Export-Import Bank of China(TEBC) | Taiwan |

| 2012 | Hong Kong Export Credit Insurance Corporation(HKECIC) | Hong Kong |

| 2012 | Export Development Canada(EDC) | Canada |

Overseas Network(Medium to long term)

1. One-Stop-Shop Reinsurance

NEXI has One-Stop-Shop Reinsurance Agreements with major overseas export credit agencies (ECAs) to cover risks in the Japanese export portion in a joint project with foreign companies conducted in a third country. For example, in cases where a Japanese company forms a consortium with a foreign company for export to a third country, the foreign company will conclude an insurance contract with their own country’s ECA for the total amount of export contract including the portion exported by the Japanese company. Then NEXI will provide reinsurance to the foreign ECA to cover the export portion of the Japanese company. This is called One-Stop-Shop because only a single application is necessary for the entire export project in which companies from a number of countries participate.

One-Stop-Shop Reinsurance

| Start of Service | ECA(Ceding Partner) | Location |

| 2002 | Servizi Assicurativi Del Commercio Estero (SACE) | Italy |

| 2002 | Atradius Credit Insurance N.V. (ATRADIUS) | Netherlands |

| 2002 | Ducroire / Delcredere (ONDD) | Belgium |

| 2003 | EULER HERMES | Germany |

| 2003 | Oesterreichische Kontrollbank Aktiengesellschaft (OeKB) | Austria |

| 2003 | COFACE | France |

| 2004 | Export-Import Bank of the United States (US EXIMBANK) | USA |

| 2004 | FINNVERA PLC (FINNVERA) | Finland |

| 2005 | Export Finance and Insurance Corporation (EFIC) | Australia |

| 2005 | Compania Expanola de Seguros de Credito a la Exportacion (CESCE) | Spain |

| 2007 | Swiss Export Risk Insurance (SERV) | Switzerland |

| 2011 | Korean Trade Insurance Corporation(K-sure) | Korea |

Domestic Network

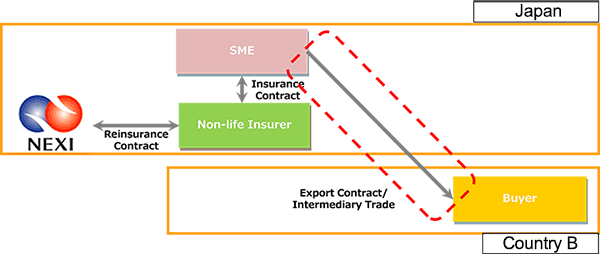

1. Reinsurance with domestic private-sector insurers(SME support)

Supporting mid-sized enterprises and smaller businesses (SMEs) is one of the government’s key policies. Under the policy, NEXI is providing a variety of measures to promote SMEs’ international business. The enhancement of the SME support is based on the revised Trade and Investment Insurance Act in 2014 that has enabled NEXI to underwrite reinsurance for export credit insurance policies issued by domestic private-sector insurers; previously, NEXI had only provided reinsurance for foreign insurers.

Following the revision, NEXI has also created a reinsurance scheme in 2015 which provides a certain percentage of reinsurance coverage for export credit insurance policies issued by domestic insurers to support SME transactions. NEXI’s offering of stable underwriting capacity has helped the domestic insurers to increase their capacity to underwrite risk in transactions with high-risk countries and more credit risk of buyers. Our reinsurance scheme will contribute to stable exports of SMEs that are using private insurance services.

NEXI will continue to actively promote SME business in the international market by strengthening our support system in cooperation with domestic private-sector insurers.

Scheme Image

Reinsurance contract with domestic insurers

| Contract Year | Insurer | URL |

| July 2015 | Mitsui Sumitomo Insurance Co., Ltd. | https://www.ms-ins.com/ |

| December 2015 | Tokio Marine & Nichido Fire Insurance Co., Ltd. | https://www.tokiomarine-nichido.co.jp/ https://www.tokiomarine-nichido.co.jp/hojin/shinyo-hosho/yushutsu/ |