Case Examples

Export Credit Insurance

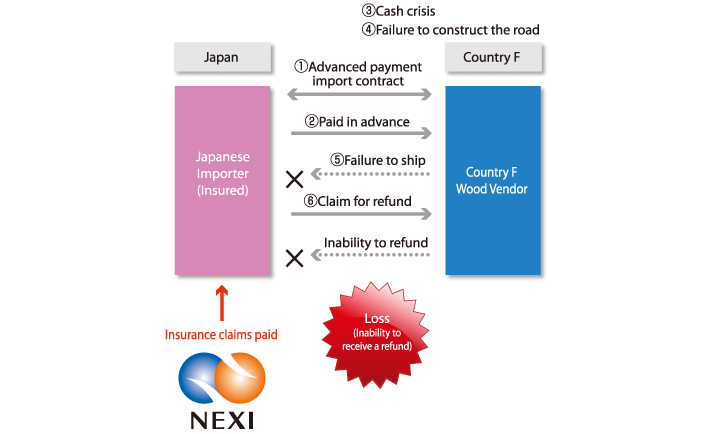

1. Inability to export

Country A imposed a 100% retaliatory import tariff on Japanese cell phones, etc. against the Japanese government’s safeguard measure. A Japanese cell phone component exporter was forced to stop shipment to Country A in response to the request from a cell phone manufacturer in Country A. Six months later Country A lifted the import tariff and the Japanese exporter asked the Country A manufacturer to resume shipment to minimize its damage. The Country A manufacturer accepted the shipment at a discount. The Japanese exporter suffered loss due to such a discount and the loss was covered by NEXI insurance.

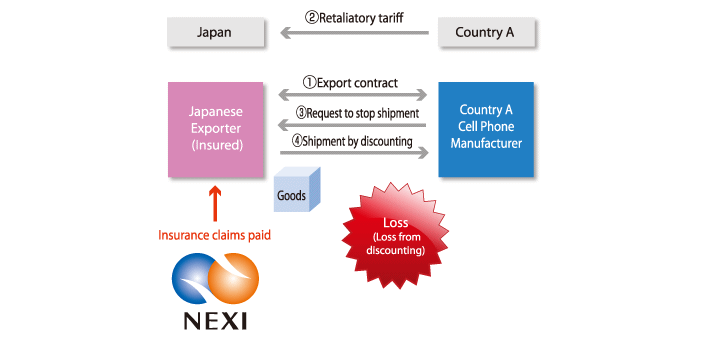

2. Inability to collect export receivables

A Japanese exporter shipped Japanese AV equipment, such as TVs and VCRs, to a consumer electronics distributor in Country B. After the shipment, Country B declared a moratorium on its external debt and changed its foreign currency exchange system from fixed rate system to floating rate system. As a result the distributor’s cash position deteriorated, burdened with debts four times greater in local currency. The exporter could not collect the export receivables and NEXI indemnified the loss.

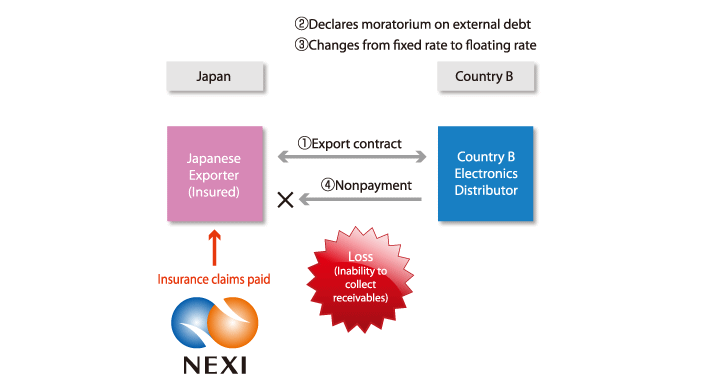

3. Unexpected expenses

A Japanese exporter arranged shipment of iron and steel products to a buyer in Country C. However, the ship was refused entry into the port of discharge because of a strike and forced to lie at anchor off the port for one month. The demurrage was charged to the Japanese exporter since the buyer refused to pay. NEXI paid insurance claims to the exporter to cover the extra expenses.

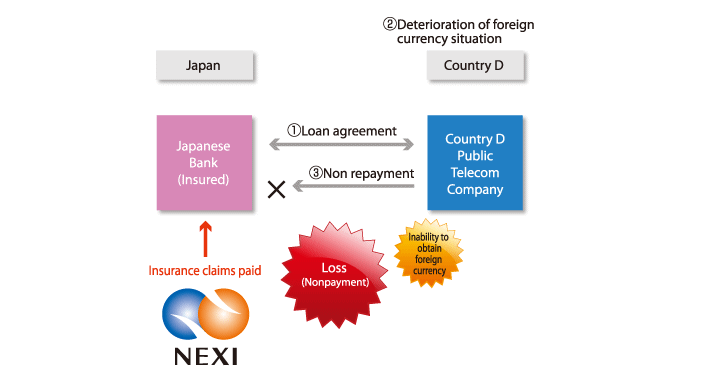

Overseas Untied Loan Insurance

Inability to collect loan receivables

A Japanese bank provided a loan to a public telecom company in Country D for mobile telecommunication equipment with repayment terms of nine years. The repayment was made on schedule at first, but later stopped because the company could not obtain foreign currency due to Country D’s foreign currency shortage. The Japanese bank suffered a loss and NEXI paid the insurance claims.

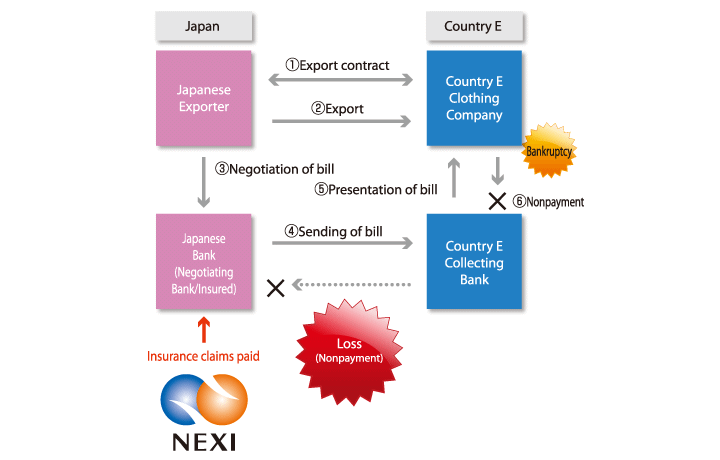

Export Bill Insurance

Nonpayment of matured bill of exchange

A Japanese exporter sold polyester goods to a clothing company in Country E, and a Japanese bank purchased a bill of exchange from the exporter. The Japanese bank asked a collecting bank in Country E to collect the export proceeds from the clothing company in Country E, but the company went bankrupt before the maturity date. The Japanese bank was unable to receive the proceeds of the negotiated bill of exchange, and NEXI covered the Japanese bank’s loss by paying the insurance claims.

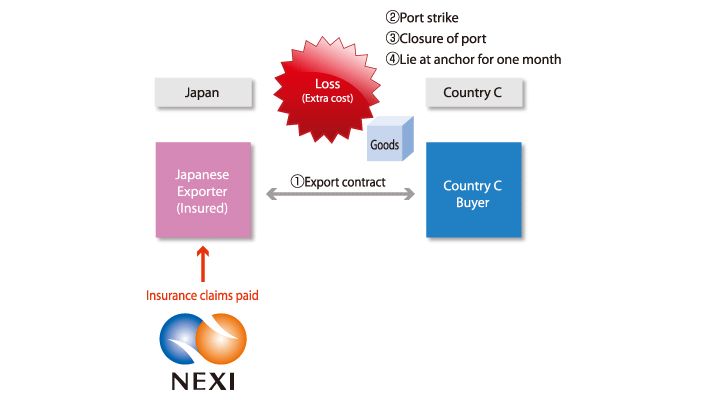

Prepayment Import Insurance

No refund for the advanced payment

A Japanese importer made an advanced payment for wood imported from a wood vendor in Country F. The vendor failed to ship the wood to the Japanese importer because the access road to the forest had not been constructed due to financial difficulty. The importer claimed a refund but could not get the payment back. NEXI covered the importer’s loss by paying the insurance claims.